The government’s drive towards digitisation of the tax system has not only shifted how landlords report their income, but also how they think about running property as a business. While the phrase Making Tax Digital is often associated with compliance, the choice of software has now become a strategic decision. Landlords who approach this as more than a tick-box exercise stand to gain efficiency, insights, and long-term resilience.

At its core, the mandate requires property owners with taxable rental income above a certain threshold to maintain digital records and submit returns quarterly. Many assume that this is simply an administrative burden, but in reality, it is an opportunity to build a smarter financial ecosystem around your portfolio. The right platform can do more than capture receipts or crunch numbers – it can reveal patterns, highlight underperforming assets, and even support better negotiations with lenders.

One of the challenges landlords face is that property ownership is rarely uniform. A landlord with a single buy-to-let in their own name will have vastly different needs compared to someone managing multiple HMOs through a limited company structure. Generic accounting tools often fail to address nuances such as mortgage interest restrictions, property-specific expenses, or capital allowance claims. That is where tailored solutions come in – and why the marketplace for MTD software for Landlords is evolving rapidly.

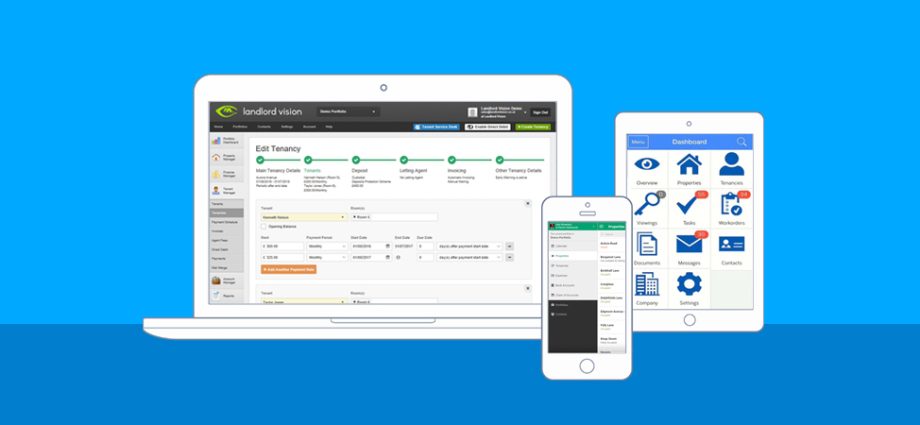

A good solution should feel less like an accounting system and more like a control panel for your property business. Imagine opening an app and instantly seeing rental yields by property, projected cash flow for the quarter, and upcoming compliance deadlines. Beyond that, the integration of open banking means you could reconcile transactions in real time, cutting down on the frantic search for missing statements when tax deadlines loom.

It’s also worth noting that many landlords underestimate the role of data accuracy. A spreadsheet riddled with small errors can snowball into expensive mistakes with HMRC, and the digital regime reduces tolerance for sloppy record-keeping. Automation offered by specialist platforms reduces these risks, ensuring that income and expenses are categorised correctly at source. In turn, this strengthens your ability to make data-driven decisions, whether you are considering a refinance or assessing the profitability of your next acquisition.

Another layer to consider is collaboration. Few landlords work in isolation – accountants, letting agents, and co-owners all play a part. Cloud-based systems allow real-time access for multiple stakeholders, which removes bottlenecks and reduces the back-and-forth of emails and attachments. An accountant can step in to review figures instantly, providing timely tax planning advice rather than retrospective corrections months down the line.

Security, too, should not be overlooked. With sensitive financial and tenant data on the line, landlords need reassurance that their chosen platform is not only HMRC-recognised but also compliant with robust data protection standards. Cheap or makeshift solutions may save money in the short term, but the risks to reputation and compliance can be disproportionately high.

As the tax landscape grows increasingly complex, landlords who view digital reporting as a burden risk falling behind. By contrast, those who see it as an investment in infrastructure will likely thrive. The software you choose today could become the foundation of how you manage, scale, and ultimately exit your property ventures.

In short, the conversation is no longer about whether to adopt digital reporting tools but about how strategically you adopt them. By selecting the right MTD software for Landlords, you are not just ensuring compliance with HMRC’s rules – you are positioning yourself to run your property business with the same professionalism and foresight as any other successful enterprise